Forex Education

Book Review Of Trade Like A Stock Market Wizard By Mark Minervini

Cодержание

- Elite Trader

- Private Access Sale

- Is Mark Minervini Legit?

- Why Is Reviewmeta Com A Must

- Trading Reflection 2021

- Analysis Of 100+ Reviews For Think & Trade Like A Champion: The Secrets, Rules & Blunt Truths Of A Stock Market Wizard

- What Is Mark Minervinis Strategy?

- 8 Keys To Superperformance By Mark Minervini The Sixth Key

- Mark Minervini

- Trade Calculators

- Minervini Private Access Review Mark’s Premium Mpa

- Book Review

This was a recurrent theme in 2021 for breakout traders. This is a great book for understanding price-action and volume. By far volume plays a key role in technical analysis and is considered by many traders to be one of the top three most important indicators. Over the past four months I’ve opened 90 trades for an average of ~1 buy per day.

Possibly ignited by a promising business outlook, a new CEO, or a big earnings surprise that beats estimates. Volume will generally contract and be relatively light compared with the previous volume. Price moves in a sideways fashion with a lack of any sustained price movement up or down. To illustrate this incredible performance, lets look at how a £10,000 account would have grown throughout that period. We explore the book and present the key criteria Mark Minervini used to do just that.

The markets continue to chop around close to recent highs; eventually, something has to give. For now, I am not guessing but playing the market with fewer positions and smaller positions while raising cash so I can pounce when the opportunities arise. It goes back and forth from written paragraphs to bullet points and links to other tools.

Elite Trader

This gave me one of my more useful risk management tactics… using bracketed stops. Look at the scale presented here to determine how many stocks you should hold based on your own individual bull trap stock market risk profile. Mark also says that the stop can be moved up when the stock rises by 2 or 3 times the initial risk, and profits should be locked in when the trend changes.

Risk management is integral to this and every trading approach. I set my stops at the low of the final contraction – a location that will only get hit if the stock fails to properly break out. In this interview, we cover how he has traded in 2021, keys to reach triple-digit returns, mindset, дневной трейдер and go over many trades he has made recently both winners and losers. Get an extra 15% off our best stock market posters & gifts. Decore your wall with our stunning stock market educational prints. Japanese candlesticks, Top Options Strategies, The Classic Chart Patterns,…

Private Access Sale

In the stock market, you have the luxury of being able to stay on the sidelines, free of charge, observing and waiting for the most opportune moment to wager. You get to see the market’s “cards” before you bet, free of charge. If you can’t be correct on your purchase with a 10% cushion for normal price fluctuation, you have a different problem to address. Either your selection criteria and timing are flawed or the overall market is hostile and you should be out of stocks.

Develop a winning trading system and start seeing results. Competition for the accolade of “World’s Best Trader” is never in short supply, but Mark Minervini’s recent performance definitely puts him up there with a pretty decent shot at the top spot. VCP is especially good for identifying stocks with growing momentum. For instance, it allows you to gauge when a security has been overbought, but when there is still strong underlying demand.

Is Mark Minervini Legit?

If you can follow only one bit of data, follow the earnings—he states. For a stock to become a t tenbagger, its market cap must increase tenfold, from $10 billion to $100 billion. “All you need for a lifetime of successful investing is a few big winners ”. He is familiar with the product and has usually tried it himself. The stock is showing some signs of life—either a sudden upmove after an extended period of decline or sideways price movement, or an abrupt spike in volume after a lengthy period of relative inactivity, or both. I’ll spare you the details in this initial correspondence, but I started trading in 2002 with $2,500 and have parlayed it into $50 million in profits (pre-tax).

- A squat is when a stock breaks out through a pivot point but falls back into its range and closes off the days high, thus squatting.

- He later agreed to answer a dozen questions in great detail straight from the ChartYourTrade Community .

- If price trades PAST that high volume area than you can find an edge buying/selling in that direction.

- Your browser will redirect to your requested content shortly.

- You should demand not only that the most recent quarter be up by a meaningful amount but that the past 2 or 3 quarters also show good gains.

- Always reference the candle to the location within the broader trend, or in the consolidation phase.

Once a stock moves up a decent amount from my purchase price, I usually give it less room on the downside. I’m certainly not going to let a good gain turn into a loss. My account simply has a new starting balance, subject to the same set of rules as before. If it pulls in, holds above the 20-day average, and squats, often the stock will recover the next day or within a few days.

The key message here is to keep reinvesting and compounding those profits, if there are frequent withdrawals then the true impact will not materialise, and neither will the super performance returns. Now, if you want to get more than your twenty-dollars’ worth, brokering definition read the last two chapter on risk management. Just like this emailer, before taking Minervini’s seminar, I was trying to “ride a stock; hold it through a violent shakeout and have the conviction not to sell it too early.” That’s not what Mark does at all.

Why Is Reviewmeta Com A Must

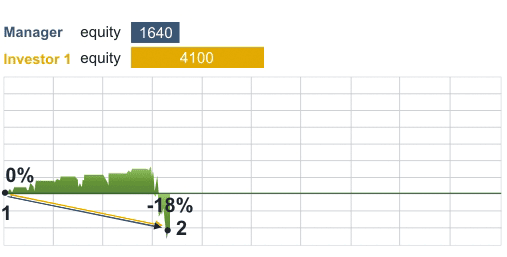

I have hidden the Dollar amount gained because it makes more sense to talk in percentages. Up until July 2021 I had made a 48% return in the Brazilian market vs a 11% Ibov benchmark. In July the market started a major downtrend and has been in this trend up until December 22nd.

A lot of these concepts could be covered in a smaller amount of pages and it did get very repetitive. Personally I will just re-read my own review when I want to remember the content. In the final chapters the author gives several examples of charts and studies from previous years Also валюты мира she suggests the use of Equivolume and candlevolume bar charts . She also gives examples of some basic chart patterns like trendlines, pennants, etc. I decided to place these chapters together because a lot of the information found here is regarding support, resistance, and trendlines.

Trading Reflection 2021

This chapter is where the author puts everything together and walks us through MANY examples of VPA analysis. The author goes through several common candlestick formations that help understand the direction of a trend. Principle Number Four A candle of the same type will have a completely different meaning depending on where it appears in a price trend. Always reference the candle to the location within the broader trend, or in the consolidation phase. This is the full market cycle explained in one image.

The problem is that these pathways will be reinforced for incorrect actions as well as correct actions. Any pattern of action repeated continuously will eventually become habit. Therefore, practice does not make perfect; practice only makes habitual. That then leads to the identification of a pivot buy point.

Analysis Of 100+ Reviews For Think & Trade Like A Champion: The Secrets, Rules & Blunt Truths Of A Stock Market Wizard

If you go in to this service knowing you have to put the work in and you are responsible for your trading you will benefit from it. If you go in just buying every “buy now” on the feed you probably won’t make money, and be over exposed. Mark says every week do not buy extended, so if you’re buying a stock extended. Opposed to waiting for Mark to post it and then scrambling валютные пары to get the trade on, not knowing the risk you’re taking and if it fits in with your risk. You then find you’ve bought a few % extended and messing up your risk reward on the trade. Mark’s method is best understood as a development of the IBD base-breakout system, popularized by William O’Neil and practiced by many different traders with their own take on it.

What Is Mark Minervinis Strategy?

The problem is that although a trendline has been broken, instead of starting a new trend, the stock could just have made a momentary move in the other direction until the prevailing trend resumes. Some IPOs can take up to a year or more to form a proper base. In most cases, you should insist that the stock put in a base of at least 3 to 5 weeks and not correct more than 25 to 35% to be reliable. The correction from peak to low point varies from 15 or 20% to 35 or 40% in some cases and as much as 50%, depending on the general market conditions. Corrections in excess of 60% are too deep and are extremely prone to failure.

8 Keys To Superperformance By Mark Minervini The Sixth Key

See all Explore all the Features Stockopedia contains every insight, tool and resource you need to sort the super stocks from the falling stars. Your browser will redirect to your requested content shortly. Always best stock trading audiobooks nice to have a trade take off right out of the gate. I’ve been tinkering around with finviz.com but ideally would like to create my own custom technical studies, which I don’t believe I can do on that platform.

Mark Minervini

As price traded through the originally marked pivot level on increased volume I initiated a position. The solid green line was the pivot level I originally identified. In a closer look last night I realized that the more recent high marked with dashed green and labeled ‘Pocket Pivot’ may be buyable as well if volume surged as price traded through that level. A 2014 study by Capital Fund Management found trend following to be a “genuine market anomaly” to the strong correlation observed between “risk premium” and tail-risk skewness.

Trade Calculators

As the leaders start to buckle, the indexes can move up farther or start to churn, moving sideways. That occurs before cash stays in the market and rotates into laggard stocks. The indexes hold up or even track higher on the backs of the stragglers. When that happens, the end is near and the really great opportunities may have already passed.

Minervini Private Access Review Mark’s Premium Mpa

If you want to make money swing trading then this is THE book to read. Literally as soon as I finished this book I started making money trading and I was up 45% in my account in 6 months following the principles laid out here. Minervini trades in a style that is similar to William O’Neal and David Ryan (pupil of Bill O’Neal and also US Investing Champion). Minervini is also a close friend to David Ryan and they are hosts of the Master Traders Program . This was by far my worst and most frustrating performance. I felt often times like quitting trading all together because I felt so stupid and incompetent.

The long legged doji can signal a reversal from bearish to bullish, or bullish to bearish, and the change in direction depends on the preceding price action. In hindsight it is easy to identify market tops and bottoms but in real-time you must wait for some type of confirmation. Start with the candle, then look for validation or anomalies of the price action by the volume bar.

Usually a stock that begins its rally and reaches a climax top will have doubled its P/E ratio . If the PE is at 50 when the stock was trading as 15 and now the stock is at 60 and the PE is at 100, this could be a potential warning sign. One key difference between an amateur and a pro is that a pro will get stopped out once or twice and be completely disconnected from that trade. An amateur might get stopped out twice and not take the stock the third time when it sets up again. Minervini illustrates how important it is to have a plan for every trade.

Book Review

A cyclical is a company whose sales and profits rise and fall in regular if not completely predictable fashion. In a growth industry, business just keeps expanding, but in a cyclical industry it expands and contracts, then expands and contracts again. Making a safe gamble in the stock market is about keeping up with the company’s fundamentals and news. If the company continues to grow and shows promise within a strong sector, odds are in you favor. If you can line up 6 out of 10 winners then you will produce an enviable record on Wall Street. So my biggest mistake was not listening to the market and continually trading.