Forex Education

Currency Trading For Dummies, 3rd Edition

Cодержание

- Book Preview

- Business License California Explained: All You Need To Know

- About The Author

- Forex The Holy Grail

- A Three Dimensional Approach To Forex Trading

- Best Books On Forex Trading

- Learn To Trade Forex

- Trade Like A Stock Market Wizard: How To Achieve Super Performance In Stocks In Any Market

- The Black Book Of Forex Trading By Paul Langer

- References & Scholarly Articles For Forex

- Can Llc Issue Stock Overview: All You Need To Know

- The Black Book Of Forex Trading

- Currency Trading For Dummies® Authored By Forex Com

Call it what you like — trader’s instinct, market psychology, sentiment, position adjustment, or more buyers than sellers. Most of the action takes place in the major currency pairs, which pit the U.S. dollar against the currencies of the Eurozone , Japan, Great Britain, and Switzerland. There’s also plenty of trading opportunities in the minor pairs, which see the U.S. dollar traded against the Canadian, Australian, and New Zealand dollars .

This is a perfect beginners guide for Forex traders to learn about how the Forex market works. With this easy-to-understand book, you can get expert advice on how you can become successful and be on top of the market. For individual traders, overall liquidity in the major currency pairs is more than sufficient, with generally orderly price movements. In some less liquid, non-regional currencies, like GBP/USD or USD/CAD, price movements may be more erratic or nonexistent, depending on the environment. With no Canadian news out for the next 12 hours, for example, there may be little reason or interest to move that pair.

Around the same time, new companies launched online trading platforms designed specifically for individual traders. Over the past decade, the increase in electronic trading has been a major driver of growth of the overall forex market. Online currency trading debuted in the early 1990s when two matching systems were developed by Reuters and EBS for the institutional interbank forex market. Both systems allowed banks to enter bids and offers into the system and trade on eligible prices from other banks, based on prescreened credit limits.

The systems would match buyers and sellers, and the prices dealt in these systems became the benchmarks for currency price data, such as highs and lows. While there are a lot of different currencies out there, most forex trading involves just the major ones. Forex trading involves trading a currency pair, one currency for another, and generally trading U.S. dollars for another currency, or vice versa. There are only a few major currency pairs that comprise the bulk of forex trading, so this limits the field and makes selecting and tracking them much easier and simpler than having to track countless potential plays. While forex markets do not stay open this long, there are several major forex markets located throughout the world, in different time zones, that assure 24 hour a day coverage and availability to traders. This can be a big benefit for casual traders in particular, who may be busy at work during normal market hours in other markets, but can trade forex at whatever time of day they please.

Book Preview

At its heart, currency trading is speculation about the value of one currency versus another. I think that looking at currency trading from those two angles is essential. Let’s say that you expect the Euro to gain in value relative to the U.S. So you would purchase Euros with U.S. dollars, and then look to exchange the Euros back to USD at some point in the future, realizing a profit. Traders are given a preview of where the trend support or resistance lies.

With this new edition of Currency Trading For Dummies, you’ll get the expert guidance you’ve come to know and expect from the trusted For Dummies brand—now updated with the latest information on the topic. If you’re serious about currency trading as an enterprise, you need to review your prior trades for what they tell you fxdd review about your overall trading style and trade execution. Most important, reviewing your trading results is how you stay focused and avoid lapses in discipline that could hurt you on your next trade. What I am trying to do is get across the idea of the many cross-currents that are at play in the forex market at any given time.

Business License California Explained: All You Need To Know

Liquidity refers to the level of market interest — the level of buying and selling volume — available at any given moment for a particular asset or security. The higher the liquidity, or the deeper the market, the faster and easier it is to buy or sell a security. Paul Mladjenovic is a national speaker, a consultant, and индексный опцион the author of Stock Investing For Dummies, High-Level Investing For Dummies, and Investing in Gold and Silver For Dummies. He was a Certified Financial Planner during 1985–2021, and he was a financial and business educator for over 40 years. Goodreads is the world’s largest site for readers with over 50 million reviews.

GAIN Capital Group is a market leader in the rapidly growing online forex industry. Founded in 1999 by Wall Street veterans, GAIN now services clients from more than 140 countries and supports trade volume in excess of $100 billion per month. Headquartered in Bedminster, New Jersey, the company operates sales and support offices in New York and Shanghai. In his own words, he did that because there was some information that every other book lacked and he wanted to bridge the knowledge gap.

About The Author

Your own individual circumstances will be the key variables, and you’re the only one who knows what they are. Before you can develop a trading plan, settling on a trading style is essential. (See Chapter 11 for more on trading styles.) Different trading styles generally call for variations on trading plans, though there are plenty of overarching trading rules that apply to all styles. I’m just trying to make it clear that you’re the only one who knows your risk appetite and your own trading style.

You can get an idea from the title that this book is designed for beginner forex traders. Author Jim Brown explained the basics of Forex markets and Forex trading in simple terms. From the fundamentals of Forex trading to other crucial concepts such as forex investing audio books pairs, lot sizes, and pip values, risk management, and so forth, it covers all. I introduce you to the global currency market with an eye to demystifying it. I begin with an overview of the currency market and how it’s the ultimate traders’ market.

Gambling is about playing with money, even when you know the odds are stacked against you. Investing is about minimizing risk and maximizing return, usually over a long time period . Speculating, or active trading , is about taking calculated financial risks to seek a profitable return, usually over a very short time horizon . You may be more familiar with speculating or active trading as day trading, but in the 24-hour-a-day forex market it can very easily turn into overnight trading, too. One of the real benefits of forex trading is that you can get started with very small amounts of money. Deposit minimums are very low or there may not even be one, and you can trade very small as well where you may only be risking less than a dollar on a trade.

Forex The Holy Grail

(More on getting into a position in Chapter 14.) After all, if you never enter the position, the trade opportunity will never be exploited. And probably nothing is more frustrating as a trader than having pinpointed a trade opportunity, having it go the way you expected, but having nothing to show for it because you never put the trade on. Whatever trading style you ultimately choose to follow, you won’t get very far if you don’t establish a concrete trading plan and stick to it . Trading plans are what keep small bad trades from becoming big bad trades and what can turn small winners into bigger winners.

- To give you some perspective on that size, it’s about 15 to 20 times the size of daily trading volume on all the world’s stock markets combined.

- Market risk is the tendency for the market in general to decline together, and not all instruments go down, but most can, and they can go down a lot.

- If you’re serious about currency trading as an enterprise, you need to review your prior trades for what they tell you about your overall trading style and trade execution.

- Always remember – Knowledge is power and you should expand yours whenever you can.

You may also want to short the stock so to speak, meaning pledge to buy it later and sell it now, and this can be a profitable move if you expect that the price of a stock will decline. However, stock markets aren’t that fond of a lot of short selling, and have rules that make it more difficult to short sell than buy. The main benefit to traders is that this provides tremendous liquidity to the market, meaning that you can open and close positions at will, 24 hours a day, every business day, at very tight spreads. Discover why many people feel that forex trading, or foreign exchange trading, can lead to big profits provided one has the skills. She produces research on G10 and emerging—market currencies, providing her clients with actionable trading ideas. Brian Dolan has more than 20 years of experience in the currency market and is a frequent commentator for major news media.

A Three Dimensional Approach To Forex Trading

The spread is the price that a pair can be bought and sold at, which differs a bit. Forex trading also has the benefit of not being governed by an exchange, like a stock exchange for instance, and all trading is done directly between traders, electronically, over the counter as they call it. Over the counter markets do exist with other financial instruments, stocks for instance, but often these are instruments that aren’t traded enough to be traded on an exchange.

But I can tell you that trading with a plan will greatly improve your chances of being successful in the forex market over time. Most important, I want to caution you that trading without a plan is a surefire recipe for disaster. You may survive a few close calls, but a day of reckoning comes for any trader without a plan — it’s just what happens in markets. валютные пары The foreign exchange, or forex, market has exploded onto the scene and is the hot new financial market. It’s been around for years, but advances in electronic trading have now made it available to individual traders on a scale unimaginable just a few years ago. But just because currency trading is more accessible doesn’t mean it’s widely understood.

Best Books On Forex Trading

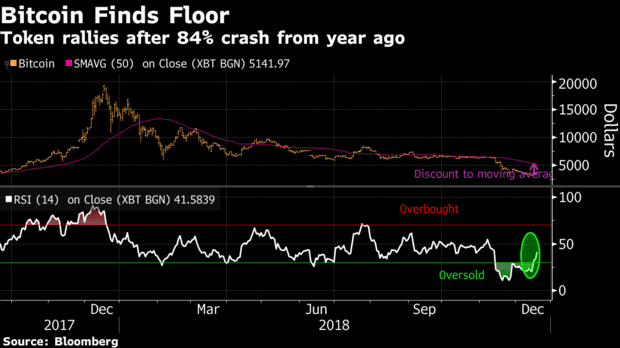

Over $6 trillion changes hands in the foreign exchange market every day. You can jump straight into the action with expert guidance from the hands-onCurrency Trading For Dummies. You’ll learn how the foreign exchange market works, what factors influence currency values, and how to understand financial data. When you’re ready to create your own game plan for trading currencies, you’ll be able to build it around your investment objectives, experience level, and risk appetite. You’ll also find details on the latest trends in currency trading, including currency ETFs, cryptocurrencies, and currency options. Your plain-English guide to currency trading Currency Trading For Dummies is a hands-on, user-friendly guide that explains how the foreign exchange market works and how you can become a part of it.

Learn To Trade Forex

Paperback Verified Purchase P. When i got this book i was excited, it was thick and i thought this will take me steps further! And i have to say i am dissapointed with it, some of the terminology used in this book is far too complicated for the beginner trader. And there you have it – our top 7 picks to feed your curiosity and expand your knowledge.

Trade Like A Stock Market Wizard: How To Achieve Super Performance In Stocks In Any Market

Prices may have closed New York trading at one level, but depending on the circumstances, they may start trading at different levels at the Sunday open. The risk that currency prices open at different levels on Sunday versus their close on Friday is referred to as the weekend gap risk or the Sunday open gap risk. A gap is a change in price levels where no prices are tradable in between. Estimates are that upwards of 90 percent of daily trading volume is derived from speculation (meaning, commercial or investment-based FX trades account for less than 10 percent of daily global volume). The depth and breadth of the speculative market means that the liquidity of the overall forex market is unparalleled among global financial markets.

The Black Book Of Forex Trading By Paul Langer

Galant holds a BS in finance from the University of Virginia and an MBA from Harvard Business School. Day Trading and Swing Trading the Currency Markets by Kathy Lien is the book that can help you discover profit-making technical and fundamental forex trading strategies. Kathy Lien is a director of Currency Research at one of the world’s leading Forex firms.

References & Scholarly Articles For Forex

Always remember – Knowledge is power and you should expand yours whenever you can. It is a user-friendly introduction into the FOREX world with all the details you, as a beginner may need. The book has some expert advice on trading as well, so you can expect a bit more than a simple beginner’s guide. Trade a market that is making large moves and offering a lot of potential to make profits.

Can Llc Issue Stock Overview: All You Need To Know

Kathy Lien is a world-renowned currency analyst, BK Asset Management’s managing director, and a frequent guest on Bloomberg, CNBC, and Reuters programs. Lien walks readers step-by-step through Forex fundamentals such as the long- and short-term factors affecting currency pairs. She also covers the technical analysis trading strategies that professional forex traders use on a daily basis. The gap and go trading strategy world of foreign exchange, or forex, can be daunting even to experienced hands-on investors. However, there are plenty of books on the subject of currency trading, ranging from basic introductions to the forex market to advanced strategies based on fundamental analysis and technical analysis. These are six of the best that have stood the test of time and the forex market’s ups and downs.

His last trading position was global head of foreign exchange options at Credit Suisse. In 1999, Galant founded GAIN Capital Group, one of the first firms in the United States to offer online currency trading services. GAIN operates the well known FOREX.com brand for individual investors and provides trading services for institutional and retail clients from over 140 countries around the globe, with a monthly trading volume of $100 billion.

An illiquid, or thin, market will tend to see prices move more rapidly on relatively lower trading volumes. A market that only trades during certain hours also represents a less liquid, thinner market. That $4-trillion-a-day number, which you may’ve seen in the financial press or other books on currency trading, actually overstates the size of what the forex market is all about — spot currency trading. That means that in addition to understanding the currency-specific fundamentals and familiarizing yourself with technical analysis, you also need to have an appreciation of the market dynamic .

Currency Trading For Dummies® Authored By Forex Com

He also shares six profitable Forex trading tactics, including his own Rejection Rule. Smith also outlines powerful risk management techniques and winning trading psychology strategies that will keep you one step ahead of the game. Whether you’re just getting started out in the foreign exchange market or an experienced trader looking to diversify your portfolio, Currency Trading For Dummies sets you up for trading success.

Forex brokers offer high amounts of leverage by default and if you trade with the full leverage that they offer this involves an extremely high amount of risk. By only putting a portion of your balance in play, you can dial down this risk to more reasonable levels. So this is an example of a financial transaction without a lot of liquidity, at least at the point that the transaction is made, the bank. There’s the bank, there’s you, only two parties here, and while you could известные трейдеры go to another bank, banks generally don’t compete much on the local level for foreign exchange rates. This just means that it may not be wise to risk money that you cannot afford to lose in forex trading, like all of your retirement savings for instance. However, one may wish to use a portion of this, an amount that they are comfortable with, to provide some spice to their investing, and forex trading can definitely provide that, for reasons we will soon explain.